The Full Stack Economist is a newsletter for entrepreneurial economists who seek to manage a nation's economy from a holistic framework. It will report information and insights on all verticals necessary to running a healthy economy. In contrast to myopic theoretical economists, this publication will cater to practical economists interested in action. Borrowing from the software concept of the full stack developer — a developer that has mastered all major areas of coding — the full stack economist is an economist that has mastered all major areas of the economy. This newsletter is a product of Ryan Research.

Lesson of the Week:

Is Joe Biden really bringing manufacturing home?

Originally published in UnHerd.

The decline of American manufacturing has been a cause for concern for decades. A point of focus for Donald Trump’s 2016 presidential campaign, his successor Joe Biden has — ironically — continued and expanded this agenda for reshoring manufacturing.

As part of his plan to “build back better”, Biden pushed through the Inflation Reduction Act (IRA) and the CHIPS and Science Act (CHIPS), which were designed to promote economic activity in domestic manufacturing — mainly green energy technology and semiconductors. Most importantly, both sets of legislation provide significant government subsidies to these sectors.

To understand if this initiative is having any effect on the market, a helpful proxy is current construction spending in manufacturing in the US. From February 2020 to April 2023, total construction spending saw a 27% increase. Within that field, manufacturing grew by a whopping 144%, with construction spending increasing by about $122 billion. This is unquestionably a significant jump, but is it going to Biden’s preferred sectors?

The CHIPS Act put a heavy emphasis on semiconductors because of geopolitical concerns. Consequently, more than 40% of recent manufacturing construction spending is in the computer/electronic/electrical (CEE) sector, which includes semiconductors. When examining the trends across these sectors, CEE appears to be driving almost all of the growth in construction spending. This means that increased activity in the semiconductor industry is happening, as far as construction of factories is concerned.

In an effort to de-risk its dependence on Taiwan as a semiconductor source, the US has made efforts to transfer Taiwanese operations, labour and capital to America. For example, the Taiwanese have broken ground on a massive semiconductor plant in Arizona that was spurred on by Trump’s strategy and continued by Biden, representing a clear boost in US manufacturing competitiveness. This project makes up a large part of the US mountain region’s $3.2 billion in recent monthly spending.

The fabled US Rust Belt has seen a relatively smaller share of spending. These areas tend to vote Democrat but also were prime locations for Trump-style populism. Rather, it is the bigger southwestern area led by Arizona and Texas that has been on the radar of American industrialists as a replacement for the Rust Belt due to its lower tax, labour, and energy costs.

With supercharged investment, this area could start to shift the poles of America’s economy from San Francisco and New York to Phoenix and Austin. It’s uncertain, though, whether the historic legacy of Republican voting patterns in these states dictates the future course of American political leadership, or if success breeds Democrat dominance.

At least for now, Biden is building. Whether he is building back better is another question. America’s overarching goal is to stop Chinese dominance of these industries, yet there’s a scenario in which Biden’s subsidies actually end up circulating back to help China grow and compete against its Western rival. What’s more, dislodging China from the supply chain dominance of the global economy involves more than just building semiconductor chips. In terms of inputs, the US has an inadequate approach to securing domestic critical materials of which China is a very dominant supplier.

In terms of outputs, many of the chips produced from these new American factories will just end up being exported to China for the final assembly of manufactured goods. This strengthens the Chinese economic ecosystem and casts light on the lack of such a holistic ecosystem within the US.

The legacy of American deindustrialisation has left the country with insufficient skilled manufacturing workers, a situation compounded by the comparatively lacklustre emphasis on building a worker education and retraining pipeline for these factories. Biden’s agenda of building back better through the IRA and CHIPS Acts may be progressing in some areas, but what is still not proven is whether this construction spending can translate into robust economic growth and security that prevents China from superseding America. This remains a monumental challenge — and the jury is out on whether the President can succeed.

News of the Week:

Rebuilding American Capitalism: A Handbook for Conservative Policymakers

“This handbook presents a comprehensive agenda for restoring conservative economics and rebuilding American capitalism. The first section, Responsive Politics, outlines capitalism’s poor performance in recent decades and defines the substantive goals toward which the American people would orient the market. The second section, Productive Markets, discusses the policy reforms necessary to align investment and the pursuit of profit with the public interest. The third section, Supportive Communities, discusses the policy reforms necessary to buttress key institutions. Each section includes an introduction, analysis and policy proposals, and commentary from Compass Advisors—all leading policy experts in their respective fields. Each advisor was asked to compose a brief memo for conservative policymakers, providing recommendations for addressing the issues at hand. The discussion of data and policy proposals is by necessity brief, but each of the ideas presented here is supported by American Compass’s in-depth research, including essays, surveys, whitepapers, policy briefs, and podcasts. These are highlighted throughout, and available on our website. We hope that policymakers will find these materials useful, and join us in advancing a conservative economics that emphasizes the importance of family, community, and industry to the nation’s liberty and prosperity.”

- Oren Cass, American Compass

Mottley in Paris, Modi in DC

“The declaration of a “New Washington Consensus”—the term given to the US’s renewed industrial strategy and its geoeconomic implications, elaborated by National Security Advisor Jake Sullivan in an April speech—by the Biden administration has faced opposition from Europe and other allies. US officials have in response invited them to not complain about protectionism and instead try the same measures. The investment-first approach to tackling the energy transition is possible for wealthy countries whose governments manage to find the political will. Middle income countries might be able to mimic the new industrial policy to a degree; nickel processing in Indonesia, or the development of EV and battery technology in India are two examples of such attempts. Smaller, poorer, and more vulnerable countries, however, have limited options when capital markets are shut, interest payments shoot up, and currencies devalue. In a striking speech last month, former US National Security Council official Fiona Hill acknowledged that “the Rest”—the middle powers or swing states—were rebelling against the West. With unusual frankness, Hill depicted global South governments’ disinterest in the war in Ukraine—subject of much hand wringing in the North—as “less a cohesive movement than a desire for distance, to be left out of the European mess.” “The Cold War-era non-aligned movement,” Hill advised, “has reemerged” and developing countries don’t want to be “caught in a titanic clash between the US and China.” She cited an unnamed Indian interlocutor asking, “where are you when things go wrong for us?””

- Kate Mackenzie and Tim Sahay, The Polycrisis / Phenomenal World

Why It Seems Everything We Knew About the Global Economy Is No Longer True

“When the world’s business and political leaders gathered in 2018 at the annual economic forum in Davos, the mood was jubilant. Growth in every major country was on an upswing. The global economy, declared Christine Lagarde, then the managing director of the International Monetary Fund, “is in a very sweet spot.” Five years later, the outlook has decidedly soured. “Nearly all the economic forces that powered progress and prosperity over the last three decades are fading,” the World Bank warned in a recent analysis. “The result could be a lost decade in the making — not just for some countries or regions as has occurred in the past — but for the whole world.” A lot has happened between then and now: A global pandemic hit; war erupted in Europe; tensions between the United States and China boiled. And inflation, thought to be safely stored away with disco album collections, returned with a vengeance. But as the dust has settled, it has suddenly seemed as if almost everything we thought we knew about the world economy was wrong. The economic conventions that policymakers had relied on since the Berlin Wall fell more than 30 years ago — the unfailing superiority of open markets, liberalized trade and maximum efficiency — look to be running off the rails…The new reality is reflected in American policy. The United States — the central architect of the liberalized economic order and the World Trade Organization — has turned away from more comprehensive free trade agreements and repeatedly refused to abide by W.T.O. decisions. Security concerns have led the Biden administration to block Chinese investment in American businesses and limit China’s access to private data on citizens and to new technologies. And it has embraced Chinese-style industrial policy, offering gargantuan subsidies for electric vehicles, batteries, wind farms, solar plants and more to secure supply chains and speed the transition to renewable energy. “Ignoring the economic dependencies that had built up over the decades of liberalization had become really perilous,” Mr. Sullivan, the U.S. national security adviser, said. Adherence to “oversimplified market efficiency,” he added, proved to be a mistake. While the previous economic orthodoxy has been partly abandoned, it is not clear what will replace it. Improvisation is the order of the day. Perhaps the only assumption that can be confidently relied on now is that the path to prosperity and policy trade-offs will become murkier.”

- Patricia Cohen, The New York Times

Australia racing to become global critical minerals superpower

“The Albanese government will commit a further $500 million from the Northern Australia Infrastructure Facility (NAIF) to help kickstart a critical minerals processing industry which it claims could create $133.5 billion in new economic activity and 262,600 new jobs by 2040. As countries rush to boost energy security and lessen their reliance on China for key minerals, such as lithium, the federal government has also announced it will conduct a review of the Australia’s critical minerals list by the end of the year. The long-awaited strategy to be released by Resources and Northern Australia Minister Madeleine King on Tuesday is hoping to give a leg-up to downstream processing and manufacturing of critical minerals in Australia which are used in batteries, electric vehicles, wind turbines and solar panels. But the race is on with other countries, as the federal government has set the ambition for Australia to be a globally significant producer of raw and processed critical minerals and build sovereign capability in critical minerals processing by 2030. This is despite concerns that have been raised about whether Australia is too expensive to have its own processing facilities or battery factories. The $500 million from NAIF is expected to be the first major investment in the sector from the federal government, which already has the $2 billion Critical Minerals Facility administered by Export Finance Australia.”

- Mark Ludlow, The Australian Financial Review

How Indonesia Used Chinese Industrial Investments to Turn Nickel into the New Gold

“The Indonesia Morowali Industrial Park (IMIP) in Central Sulawesi is one of the largest Chinese investments in Indonesia, touted by its creators as a perfect model of Sino-Indonesian collaboration. Yet while it indeed symbolizes the strong synergy between Chinese investment and Indonesian President Joko Widodo’s developmental plans for his country, the park also encountered several contestations, at the local, national, and even—albeit indirectly—international levels. Chinese players have had to adapt to these rapidly shifting Indonesian cross-currents. The way they have done so says much about the extent to which they have learned how to navigate local realities in today’s Indonesia. The industrial park bears the imprint of a typical export growth–oriented Special Economic Zone from China. Built in a pristine yet resource-rich area in Central Sulawesi, it brought development in the form of new infrastructure like ports, roads, and airports, which connected this once dormant part of the country to other parts of Indonesia and onward to the rest of the world. It also brought new technology, capital, and employment to the country, attracting migrant workers from the whole of Sulawesi to move into this area of the island. Two main factors propelled its development: China’s Belt and Road Initiative (BRI), which provided a launchpad for elevating this project to a strategic national level of priority, with all the facilitations this entailed; and the export ban on raw minerals implemented by the Indonesian government, which essentially forced Chinese companies to invest in Indonesia’s smelters to keep hold of their sources of nickel.”

- Angela Tritto, Carnegie Endowment For International Peace

Understanding Sequoia's high-profile split from China

“Sequoia Capital's rupture from its China and India businesses has the tech world talking, but few close watchers of the firm were surprised by the dramatic change…Rising geopolitical tension between the US and China is an obvious catalyst for Sequoia's high-profile decoupling. But the rift between Washington and Beijing is likely not the only impetus for the storied firm's geographical dissolution…The Biden administration reportedly plans to issue an executive order restricting investments in China in certain sensitive technologies such as advanced semiconductors, AI and quantum computing. China already restricts foreign investment into sensitive industries. Many venture capital investors have also come to recognize generative AI as the most significant technological paradigm shift in over a decade and refocused their investment efforts to AI companies.”

- Marina Temkin, PitchBook News

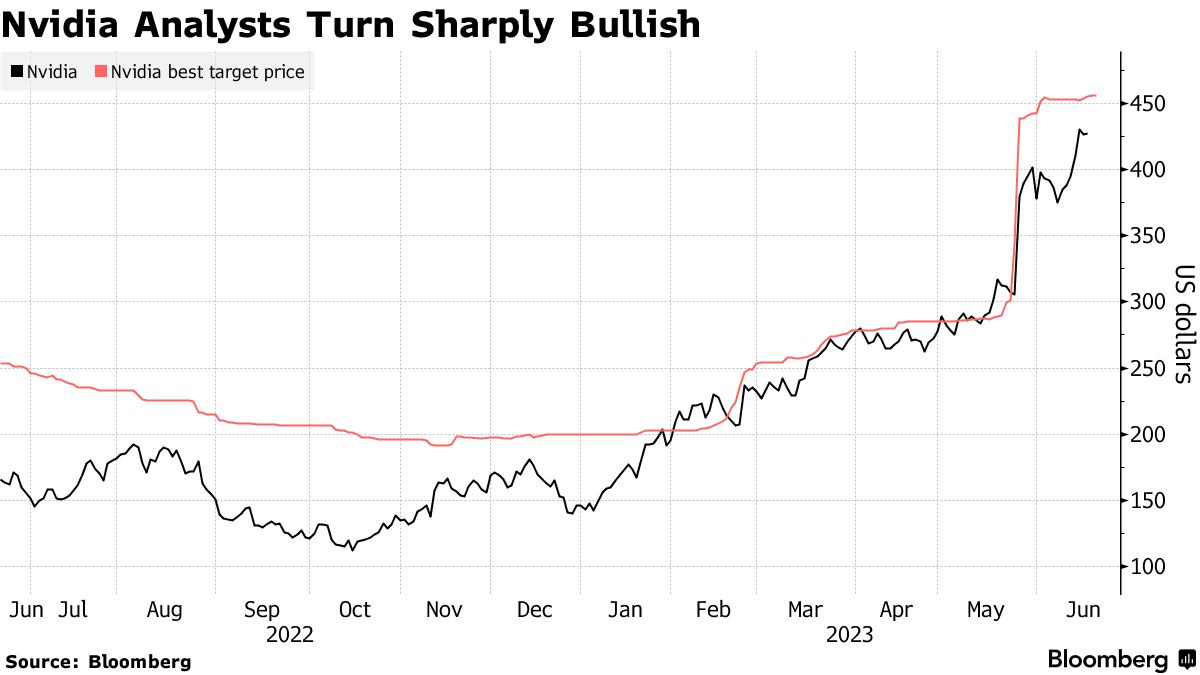

Analyzing NVIDIA’s growth strategy: How the semiconductor leader is powering generative AI and the future of computing

“We mined NVIDIA's acquisitions, investments, and partnerships to discern the company's strategic priorities. NVIDIA, a fabless firm that designs chips manufactured by others, has become the largest semiconductor company in the world. Its market capitalization hovers just below $700B. This achievement is partly attributed to its pioneering work in accelerated computing, which uses specialty hardware to complete demanding software tasks much faster than previously possible.”

- CB Insights

The Cantillon Effect and Bank Behemoths

“An 18th century French banker and philosopher named Richard Cantillon noticed an early version of this phenomenon in a book he wrote called ‘An Essay on Economic Theory.’ His basic theory was that who benefits when the state prints a bunch of money is based on the institutional setup of that state. In the 18th century, this meant that the closer you were to the king and the wealthy, the more you benefitted, and the further away you were, the more you were harmed. Money, in other words, is not neutral. This general observation, that money printing has distributional consequences that operate through the price system, is known as the “Cantillon Effect.”… Cantillon was making a claim about power, asserting that the institutional channels through which money flows determine whether credit expansions or contractions, aka monetary policy, help or hurt everyone equally. If institutional channels are limited to speculators, then speculators will benefit from credit expansions. If those channels are decentralized, as they were from the 1930s to the 1980s, then money will move in a more fair way. Monetary policy, in other words, is not neutral, unless we build political institutions to ensure that neutrality. Local banks and credit unions are such institutions in America. And that brings me to today’s fight over banking. The Patman era lasted until the 1980s, when most elites thought banking needed to be consolidated. In 1980, we had around 15,000 banks. Today, with a much larger country, we have less than 4,000. And one reason is that from Reagan onward, bank regulators and antitrust enforcers waved through mergers.”

- Matt Stoller, BIG

America Still Leads the World, But Its Allies Are Uneasy

“On recent visits to Lisbon and Paris, I heard much discussion of American leadership. I was reminded of what Mahatma Gandhi supposedly said when he was asked for his view of Western civilization — that it would be a very good idea. I feel the same way about American leadership: It would be a very good idea. It’s a view that seems to be quite widely shared within the European elite, though few of the continent’s leaders dare to say so out loud…US leadership would indeed be a good idea. A trip to Europe undermines your faith in it. It is partly, of course, the diminishing credibility of Reagan’s “shining city on a hill” as a role model — understandable when a former president may have to win reelection next year to avoid going to jail. But there is something more profound at work. The US today is the undisputed leader of Spykman’s Rimland against the Heartland, much as it was in the 1950s. But the Rim is somehow thinner than it was back then. And today it shows the first worrisome signs of cracking.”

- Niall Ferguson, Bloomberg

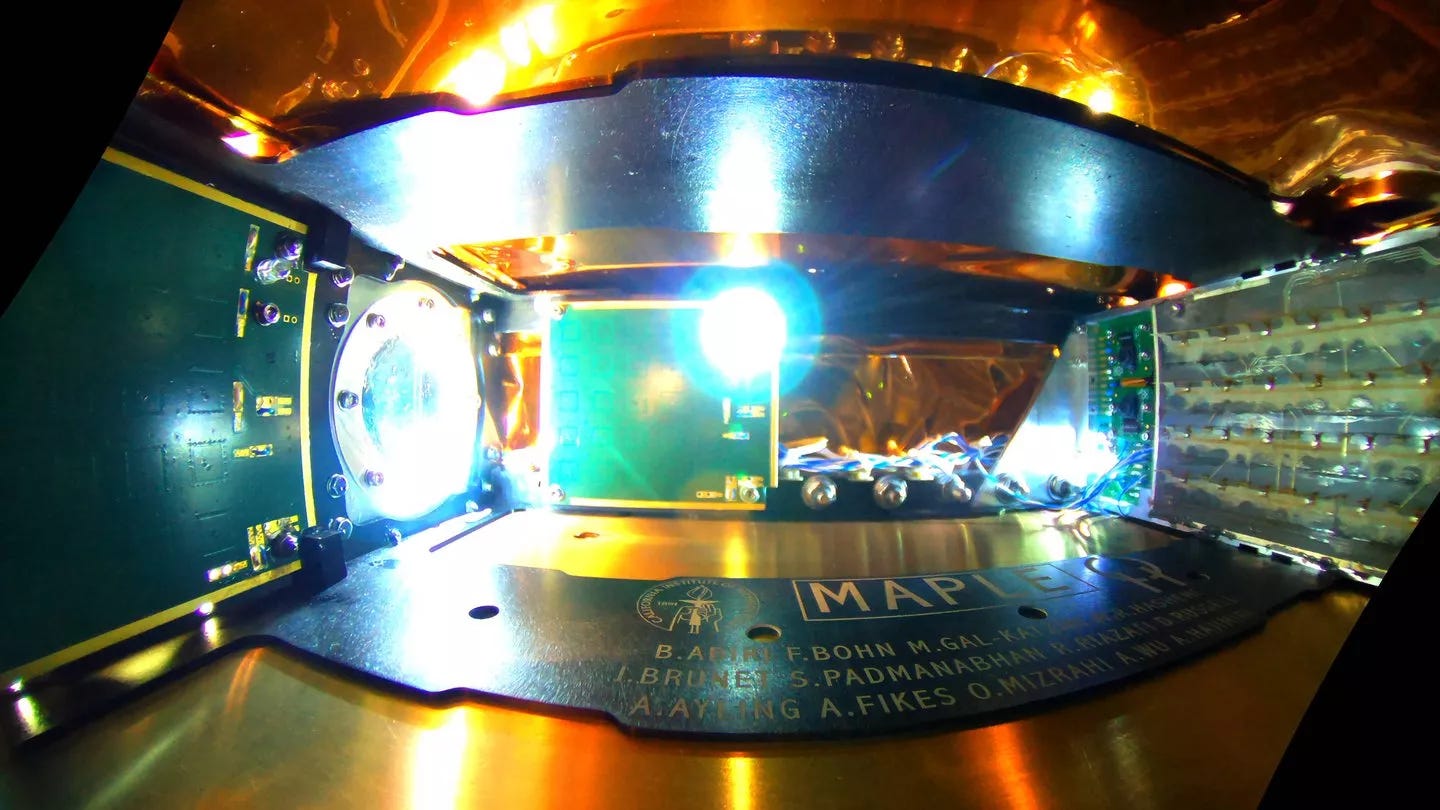

Scientists beam solar power to Earth from space for first time

“A space solar power prototype has demonstrated its ability to wirelessly beam power through space and direct a detectable amount of energy toward Earth for the first time. The experiment proves the viability of tapping into a near-limitless supply of power in the form of energy from the sun from space. Because solar energy in space isn’t subject to factors like day and night, obscuration by clouds, or weather on Earth, it is always available. In fact, it is estimated that space-based harvesters could potentially yield eight times more power than solar panels at any location on the surface of the globe.”

- Robert Lea, Space.com

Top 10 biggest global manufacturing leaders

“Caterpillar Inc., Siemens, Honda, Ford, BMW, Samsung, General Motors, Toyota, Volkswagen & General Electric are our Top 10 global manufacturing leaders. Read more for full details on these companies.”

- Helen Sydney Adams, Manufacturing