The Full Stack Economist is a newsletter for entrepreneurial economists who seek to manage a nation's economy from a holistic framework. It will report information and insights on all verticals necessary to running a healthy economy. In contrast to myopic theoretical economists, this publication will cater to practical economists interested in action. Borrowing from the software concept of the full stack developer — a developer that has mastered all major areas of coding — the full stack economist is an economist that has mastered all major areas of the economy. This newsletter is a product of Ryan Research.

Lesson of the Week:

Is AI Hype, Hope, or Hallucination?

In economics, the classic production function is economic output is equal to capital times labor or simplified as Y = KL. Capital can be money, machinery, or property but it is most importantly controlled by capitalists. Capitalists’ natural incentive is to substitute capital for labor because that maximizes profits that don’t otherwise need to be shared with labor as well as reduces the risk of human agency of labor if machinery replaces them. One scenario is that this process expands output so much that the negative effects on labor are offset by their increased consumer options and opportunities for employment in an expanded and more developed economy. Another scenario is that output doesn’t expand and labor retains those negative effects while being made more unequal to the capitalists.

Goldman Sachs forecasted that AI could replace 300 million global jobs. In the more developed economies, they also noted that AI replacement could be more dominant. Their conclusion was that in 10 years it could be possible for AI to deliver a 7% increase in global GDP. Let’s call this the “assume everything goes right” case. Even in this case, they admit in the short-term there will be many displaced workers however their contention is that AI will be so productive that over 10 years those displaced will rebound. However, the Goldman Sachs report leaned on academic economic reasoning to argue its case. Jumping into reality we see another story.

The past 12 months have seen the global tech sector (centered in Silicon Valley) go through an internal correction. Venture capital funding is at historic lows, public market appeal has dimmed, institutions like Silicon Valley Bank have cratered, and interest rates have shifted to unprecedented highs. These conditions, combined with the rise of AI, led to over 350,000 people losing their jobs in tech over the past year. The appetite for new hiring has shrunk too. “Recent data from Indeed shows a more than 50% decline in software-development job postings compared to a year ago” (Insider). Between memos, interviews, and earnings calls, the global tech sector is not saying they want to make their workers more productive in isolation. The global tech sector, or better defined as the capitalists of the global tech sector, are saying that they want to get rid of their existing labor, replace it with AI, and have no plans to rehire in the future.

While we are only in the beginnings of the AI revolution, it seems odd that academic economists or their counterparts in high finance speak in inverse terms to what is occurring in the actual market. The global tech sector is the tip of the spear for the rest of the economy. They are saying right now they want to fire workers not retrain them with AI to up their productivity. They are saying they don’t want to hire workers in the future because AI can be used to keep low headcounts. Remember the smaller the share of labor in production the more profits capitalists retain. So we are confronted with a pressing problem of society being made more unequal and no plan to support the displaced workers. The “assume everything goes right” case relies on the capitalists doing the opposite of what they are explicitly saying they are doing right now — firing and not rehiring.

The other key question to be looked at is: will AI be as revolutionary and pervasive as the hype suggests it will? While all our imaginations are tickled by sci-fi fantasy, we must not let lofty tropes cloud reality. The reality of what we mean by “AI” is a particular type of technology called a large language model (LLM). They are simply probability machines. That’s it. They don’t understand the words they are ingesting or spitting back out to us. They calculate relationships between words, which they see as numbers, based on immense amounts of data and conditions set by software engineers. This allows them to do pretty impressive things but they are not anywhere close to some of our sci-fi fantasies.

Ironically, the best applications for this type of AI are in things we might call fictional activities. MidJourney is an AI app that turns user-generated text-based prompts into fully visualized images. Eleven Labs is an AI app that turns user-generated text-based scripts into audio voice emulations sourced from sample audio. Even the most famous AI app, ChatGPT by OpenAI, can be easily used to automatically write movie scripts. These are examples of a plethora of other apps that leverage AI to create fictional products. These tools have the potential to displace a lot of work in graphic design, marketing, and creative fields.

When applied to non-fiction, AI’s potential seems to have been revealed to be much more limited. We just saw the first time AI actually touched the real-world. “Last week, attorney Steven Schwartz allowed ChatGPT to ‘supplement’ his legal research in a recent federal filing, providing him with six cases and relevant precedent — all of which were completely hallucinated by the language model. He now ‘greatly regrets’ doing this, and while the national coverage of this gaffe probably caused any other lawyers thinking of trying it to think again…All attorneys appearing before the Court must file on the docket a certificate attesting either that no portion of the filing was drafted by generative artificial intelligence (such as ChatGPT, Harvey.AI, or Google Bard) or that any language drafted by generative artificial intelligence was checked for accuracy, using print reporters or traditional legal databases, by a human being…These platforms in their current states are prone to hallucinations and bias. On hallucinations, they make stuff up—even quotes and citations. Another issue is reliability or bias. (TechCrunch)”

Much of the coverage of AI had been around fictional applications. Many were impressed at the capabilities like that of generating images but the stakes never amounted to more than “that’s pretty cool.” These fictional AI apps don’t really have real-world consequences. The recent courtroom example showcased what happens when you try to bring AI into the real-world. AI provided bogus information in an official legal document. It revealed a huge problem for AI which are hallucinations. It’s a more sophisticated term than what it simply is — error. AI LLMs don’t know what is true or false, they just see numbers and probability relationships. The goal is to output the most probable relationships which approximate answers to our prompts. Unfortunately, this doesn’t always provide us with the truth but content that looks very much like the truth. For example, I tested this by asking a series of economic research questions. It provided me very plausible answers and links to sources at real data providers. However, when I went to double check at the source, I realized that there was no such data there. The AI made up fake statistics, claimed a legitimate institution as its source, and gave a realistic-looking URL.

It is possible that hallucinations can be remedied but AI’s rapid expansion will increase risk. It is unclear if every edge case can be accounted for by AI technologists if AI does expand outside the “that’s pretty cool” sphere to where Goldman Sachs thinks it will in 10 years. Can doctors be sued for malpractice if they provided care based on an AI hallucination? Can a real estate developer be sued if their building was engineered on designs based on an AI hallucination? The list of potential problems is infinite. Who is willing to create a giant liability by using AI for non-fictional activities that have real-world consequences? We already have digital technology and automation services, but we’ve grown our professions in a way that still maintains a level of human checks and balances. That seems to be the reply to these concerns but let’s not pretend that has real meaning. Part and parcel of this AI revolution are human checks and balances getting automated too. The global tech sector is firing at an incredible rate with no plans to rehire. Goldman Sachs forecasted 300 million global job losses and 2/3 of certain professions being especially vulnerable. You don’t do that and reap the maximized profits or 7% global GDP growth by keeping those costly and burdensome human checks and balances around.

The true hurdle that AI might not get over is the infinite downside in liability for non-fictional activities with real-world consequences which overshadows its positive yet finite upside. Let’s call this the “I’d rather not be sued for eternity” case. If this is what the future holds, the gains from AI productivity could be very positive but limited to creative fields that primarily output fictional products. There would be a hard ceiling for the non-fiction economy and human labor would be stickier. AI might augment, but it could never fulfill the forecasts that corporate boardrooms and academic economic ivory towers think it can. The medium-term could also reveal private sector turmoil from capitalists incorrectly hollowing out their labor pools in expectation of AI gains that never materialize.

Media of the Week:

Podcast: Japan: A Case Study in MMT with Bill Mitchell (Real Progressives)

Twitter Spaces Recording: Multipolarity: Update and Q&A with Adam Collingwood and Philip Pilkington (Multipolarity Podcast)… I make a guest appearance.

Podcast: The ‘free market’ is a fever dream and Adam Smith wasn’t in it with Jacob Soll and Mark Blythe (Rhodes Center Podcast)

News of the Week:

The U.S. Needs Minerals for Electric Cars. Everyone Else Wants Them Too.

“As the world shifts to cleaner sources of energy, control over the materials needed to power that transition is still up for grabs. China currently dominates global processing of the critical minerals that are now in high demand to make batteries for electric vehicles and renewable energy storage. In an attempt to gain more power over that supply chain, U.S. officials have begun negotiating a series of agreements with other countries to expand America’s access to important minerals like lithium, cobalt, nickel and graphite.”

- Ana Swanson, The New York Times

Qatar Warns Europe of Gas Shortages in Switch to Renewables

“Qatar warned that governments’ energy-transition policies will discourage investment in fossil fuels and lead to scarcities of natural gas in the coming decade, including in Europe. “There’s going to be a big shortage in gas in the future, predominantly because of the energy-transition push that we’d say is very aggressive,” Saad al-Kaabi, Qatar’s energy minister, said at the Qatar Economic Forum in Doha on Tuesday. “Economic stability and environmental responsibility are not mutually exclusive. You have to have both.””

- Verity Ratcliffe and Paul Wallace, Bloomberg

China’s loans pushing world’s poorest countries to brink of collapse

“Behind the scenes is China’s reluctance to forgive debt and its extreme secrecy about how much money it has loaned and on what terms, which has kept other major lenders from stepping in to help. On top of that is the recent discovery that borrowers have been required to put cash in hidden escrow accounts that push China to the front of the line of creditors to be paid. Countries in AP’s analysis had as much as 50% of their foreign loans from China and most were devoting more than a third of government revenue to paying off foreign debt. Two of them, Zambia and Sri Lanka, have already gone into default, unable to make even interest payments on loans financing the construction of ports, mines and power plants…China’s unwillingness to take big losses on the hundreds of billions of dollars it is owed, as the International Monetary Fund and World Bank have urged, has left many countries on a treadmill of paying back interest, which stifles the economic growth that would help them pay off the debt. Foreign cash reserves have dropped in 10 of the dozen countries in AP’s analysis, down an average 25% in just a year. They have plunged more than 50% in Pakistan and the Republic of Congo. Without a bailout, several countries have only months left of foreign cash to pay for food, fuel and other essential imports. Mongolia has eight months left. Pakistan and Ethiopia about two.”

- Bernard Condon, AP

Meet The Texas Startup That Recycles Rare-Earth Magnets, Bypassing China

“At a factory in San Marcos, Texas, workers gather Bird scooters, computer hard drives, MRI machines and motors from hybrid cars in order to separate out the old rare-earth magnets so they can be ground down and shaped into new ones. These strong permanent magnets are everywhere, even if most people know nothing about them. They go into everything from electric vehicles to wind turbines to consumer electronics to missile guidance systems. Yet for years, the U.S. has been largely dependent on China for rare-earth processing. Noveon Magnetics, the startup behind this recycling effort, has a grand plan — and some patented technology — to make a dent in that dependance.”

- Amy Feldman, Forbes

FACT SHEET: Biden-Harris Administration Announces National Standards Strategy for Critical and Emerging Technology

“The Biden-Harris Administration released the United States Government’s National Standards Strategy for Critical and Emerging Technology (Strategy), which will strengthen both the United States’ foundation to safeguard American consumers’ technology and U.S. leadership and competitiveness in international standards development. Standards are the guidelines used to ensure the technology Americans routinely rely on is universally safe and interoperable. This Strategy will renew the United States’ rules-based approach to standards development. It also will emphasize the Federal Government’s support for international standards for critical and emerging technologies (CETs), which will help accelerate standards efforts led by the private sector to facilitate global markets, contribute to interoperability, and promote U.S. competitiveness and innovation.”

- The White House

Cheap Electricity and Robotics

“Based on a 2017 paper from Applied Energy Group, an average industrial robot operating for 20 hours a day across a whole year has an annual usage of 22 Megawatt hours (MWh). There are around 3.5 million industrial robots installed worldwide. Based on this, the yearly consumption of all industrial robots annually is about 77 terawatt hours (TWh). This is comparable to the electricity consumption of Algeria or Finland. It represents 0.28% of the electricity demand for the world in 2022. That is for industrial robots, which are the most energy-intensive systems from an annual electricity standpoint.”

- Rian Whitton, Doctor Syn

Central bank digital currency policies in open economies

“Central banks worldwide are actively considering issuing digital currencies. This column studies the macroeconomic and financial stability implications of their issuance, and of alternative arrangements for their management. It finds that a CBDC interest rate rule that responds to credit delivers the most effective stabilisation of real and financial activity, including reductions of around one third in the volatilities of capital flows and exchange rates. CBDC issuance of 30% of GDP in one country raises long-run output by almost 6%.”

- Michael Kumhof, Marco Pinchetti, Phurichai Rungcharoenkitkul, and Andrej Sokol, Center for Economic Policy Research

Why I'm Excited About The Industrial Policy Renaissance

“In March I wrote a piece for the New Statesman outlining the industrial policy turn in both the US and the EU. Drawing from development history, I tried to show why these changes amount to something profound and historic. What we call industrial policy today has its origins in the Renaissance and in Tudor England and its tried and tested success produces not just a more equally prosperous society internally but also greater national power in the world. One of the foundational texts of this historical line of thought is quite literally called Austria Supreme if it So Wishes: A Strategy for European Economic Supremacy, written in 1684 by Philipp von Hörnigk. This isn’t just a policy change like tinkering with the tax rate. Industrial policy - the use of state direction to build up national increasing returns activity and internal improvements - is the foundation for building up all other forms of power.”

- Angela Nagle

Lidar and the Future of Computer Vision

”Lidar, short for “light detection and ranging” (similar to “radar”, which is an acronym for “radio detection and ranging”), has emerged as a technology that significantly improves perception for both humans and machines. While traditional visual perception relies on capturing light to create 2D images and then infusing them with depth information, lidar captures a 3D model of its environment from the get-go. It does this by shooting tiny laser beams and measuring the time it takes them to reflect off of surfaces to calculate the distance that the laser beams traveled. By shooting hundreds of thousands of little laser beams at a time, lidar can create a fully accurate 3D scan of its surroundings. Though its core technology has been around for over half a century, it’s only within the previous twenty years that lidar has found its killer app: autonomous driving. The demand from the self-driving industry has transformed lidar from a rarity to an increasingly ubiquitous technology that’s already installed in all modern iPhones. It unlocked new vistas, allowing us to do everything from measure continental drift, dock spacecraft to the ISS, and discover lost cities. But there’s still a lot of potential for further advancement with lidar, because the economics of scaling haven’t even fully kicked in yet. With the prospect of Moore’s Law-like improvements in precision and cost for lidar technology over the coming years, it’s high time to review the history of lidar and explore its potential impact across the future of industries and consumer goods.”

- Anna-Sofia Lesiv, Contrary

Populism, Federalism, and the American System

“Drawing on history, the proponents of the new American System have pointed to a number of policy prescriptions, ranging from industrial policy to Opportunity Zones, to uplift struggling regions as part of broader national economic development goals. The new populists, on the other hand, have so far offered no agenda for struggling regions. Once central to the movement, regional identities have taken a backseat to other culture war identities. Buchanan’s work on fiscal equity and the case for an equalization block grant could start that agenda for any entrepreneurial leader looking to revive this dormant movement into a national powerhouse again.”

- Joshua McCabe, The American System

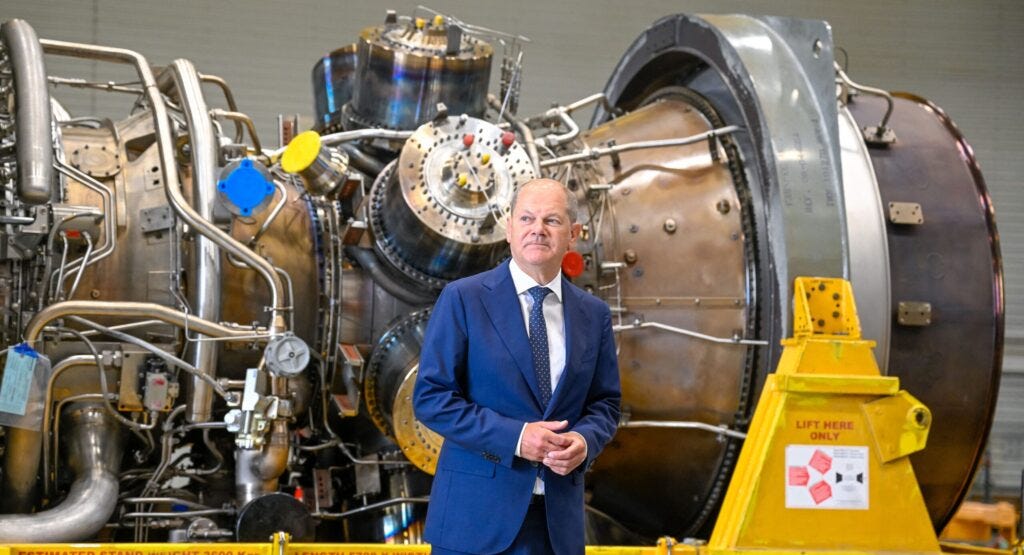

Recession in Germany is a sign of Europe’s deindustrialisation

“Last week Germany announced that, after the government statistics agency revised its recent GDP figures, it was clear that the country was in recession. In recent history it has tended to hold up well as the global economy softened relative to some of Europe’s weaker economies. But this time it seems that Germany is leading the pack into recession. This is because the recession that is currently looming over Europe is fundamentally different from previous iterations. The coming recession is no simple turning of the business cycle. Instead, it could be the beginning of the deindustrialisation of the European economy, which no longer has access to cheap Russian energy.”

- Philip Pilkington, UnHerd