The Full Stack Economist is a newsletter for entrepreneurial economists who seek to manage a nation's economy from a holistic framework. It will report information and insights on all verticals necessary to running a healthy economy. In contrast to myopic theoretical economists, this publication will cater to practical economists interested in action. Borrowing from the software concept of the full stack developer — a developer that has mastered all major areas of coding — the full stack economist is an economist that has mastered all major areas of the economy. This newsletter is a product of Ryan Research.

Chart of the Week:

Charlie Bilello shared this heatmap of US Treasury yields at different maturities. The takeaways are 1.) the novelness of the inverted yield curve in most right 2 columns and 2.) the historical shift from long-term optimism to pessimism. The inverted yield curve should signal an economic downturn in the US’ future. The longer-term trend of overall pessimism may signal structural degrowth of the US economy.

talked about this in his latest Multipolarity Podcast episode. He advised that while the US and wider developed world might see indicators like this as signs of trouble, the developing world is seeing bullish indicators such as a surge in copper demand (501% YoY). He calls this the Great Divergence: rather than uniform global growth or decline as in the past, the world will be split between growing regions and declining regions.Lesson of the Week:

Human Resources: Fertility

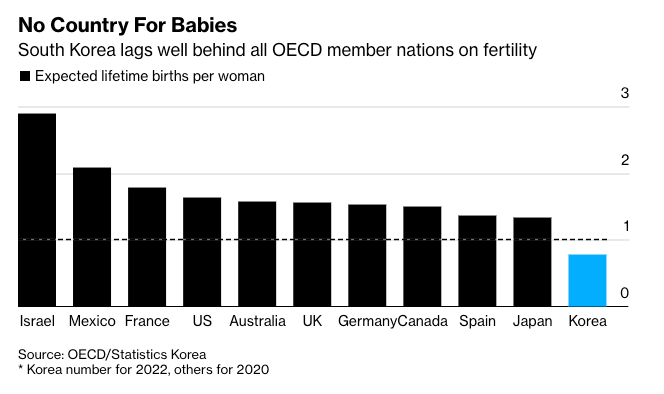

South Korea made headlines because of its startling low ranking in fertility. At .78 expected lifetime births per woman, South Korea is one of the lowest ranked among more than 260 nations tracked by the World Bank and the absolute lowest among the 38 members of the OECD. It has surpassed typical examples of low fertility like Germany and Japan. The standard for replacement level fertility is 2.1. While South Korea is mirroring similar trends across the developed world, what could be the reasons for its outlier status? Likely factors include economic hardship on the younger generation, increased female labour participation rate, and high urban concentration.

South Korean youth are disadvantaged because the older generation is distorting the economy by working later and wider while also having had a better initial rise in their youth. “South Korea’s legion of older workers has helped keep the jobless rate low but has exacerbated record low employment among the young - less than half of those aged 15 to 29 have jobs. It is also a cause of the decade-long stagnation in wage growth, dampening consumption.” Due to relatively low welfare programs in South Korea and cultural factors, South Korean elderly are uniquely more likely to work longer boxing out the youth from jobs that otherwise should go to them. The labour supply increase has also depressed wage growth. Additionally, the distribution of wealth in South Korea is skewed older and compounded by the higher growth rates experienced decades ago compared to lower growth rates today (9-10% growth in 1990s vs. 2-3% growth today).

South Korea has a higher female labour force participation rate than the OECD member average. The rapid rise of females in the workforce, as well as a shift to modern vs. traditional female economic activities, means that there are necessarily less females engaging in family formation. Additionally, this increase of females into the labour supply further pushes down wages just like the way older generations do.

Finally, South Korea has a very high central urban concentration. 20% of South Korea’s population lives in Seoul. Now compare this to 10% for Tokyo-Japan, 10% for London-UK, 10% for Dublin-Ireland, 2% Paris-France, and 4% Berlin-Germany. While there are nuances in distribution of urban centers contrasted to single urban centers, the highlight is South Korea has an abnormally high level of citizens in a densely populated city. Urban centers are generally population sinks. People have less room, more costs, more distractions, etc. Fertility will always be lower in cities.

In conclusion, South Korea’s fertility problem is caused by 1.) the older generation’s refusal to retire leading to increased labour competition and wage depression as well as wealth inequality from a faster growing economy in their youth 2.) an increase in female labour force participation rapidly leading to less females in the pool for family formation and an additional labour supply augmenting factor which depresses wages 3.) the very high centrality of the population in the main urban center which acts as a major drag of fertility. These factors are all compounded by a general lack of government supports whether it is for the elderly or child-rearing. The most impacted by these trends are South Korean young men who are either unemployed or underemployed which makes them less competent at family formation if their socioeconomic status is relatively similar to or lower than that their female counterparts.

A full stack economist should consider all these variables in economic policy. While crude changes like capping elderly and females in the work force might shift fertility, more elegant policies like increased welfare payments or debt reductions based on fertility-enhancing activities could do the trick while reaping the benefits from the modern trends. Additionally, building more medium cities or tech-enabled villages could reverse the urban sink effect. Culture is also an underlooked X factor. Policies in shaping attitudes around family and lifetime goals through media and education could rectify these issues too. The downside of letting your nation’s fertility crater is an unsustainable economic system where there aren’t enough workers increasing output, consuming, or paying taxes into the system.

News of the Week:

The Great Financial Tightening

Today, we’re already witnessing the early innings of the Great Financial Tightening™. Rates and volatility markets are starting to price in higher for longer. Financial conditions indices are beginning to turn sour. And leading indicators are starting to matter. The disconnect between fundamentals and markets has yet to fully converge, but the Great Financial Tightening™ will bring an end to the latest liquidity splurge. Goldilocks is almost over. Now it’s time for volatility to make an unwelcome return.

-

Steel isn't strong, boy!

Since my piece on Britain’s steel sector, the situation has deteriorated at an alarming rate. Events are moving faster than I imagined, and the crisis looks comparable to that of 2015-2016. For months there have been negotiations over new subsidies to prevent a downscaling of operations and fund new electric arc furnaces (EAFs). In January, the government offered both Jingye (owner of British Steel) and Tata Steel £300 million each. Tata had originally asked for £1.5 billion in funding when negotiations began in 2022 while Jingye asked for £1 billion.

“Over the 2002 to 2013 period, European steelmaking reduced the net global emissions burden of the steel industry by an estimated 9.2 million tonnes of CO2. In the period since then, the decline of European steelmaking has added 15.3 mtCO2 to the industry’s net global footprint.” - Seb Kennedy

-

,Big Asian economies take on the forces of international capital—and win

The experience of large currency-reserve holders during the dollar’s recent surge might give governments other ideas. Being able to resist the pressure to follow the Fed’s interest-rate movements is a goal held by many developing economies—and the more reserves they hold, the more resistant they seem to become.

- The Economist

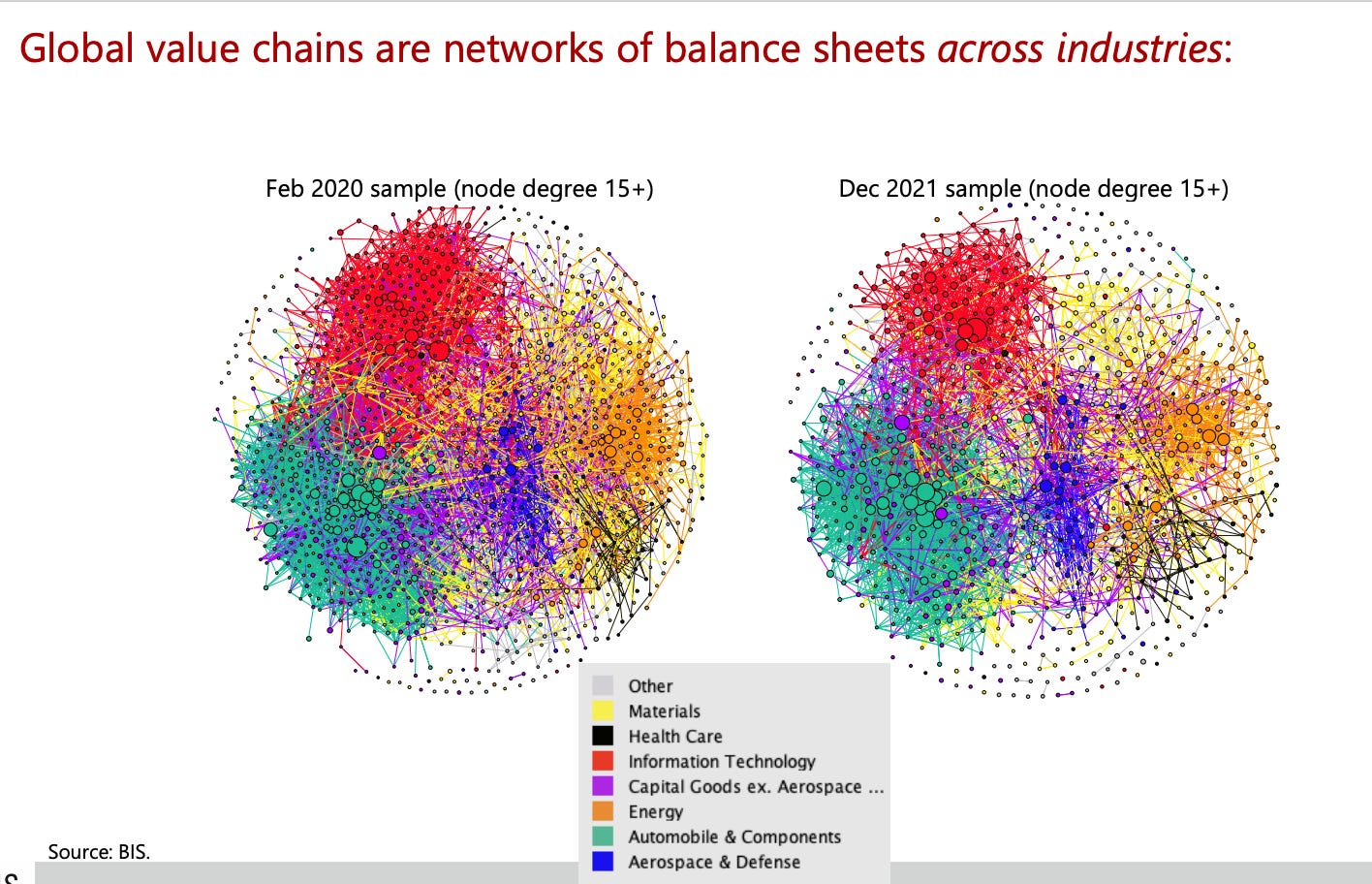

Chartbook #198 Globalization: The shifting patchwork

Apart from their inherent fascinating, the significance of these diagrams for the discussion about globalization is that they demonstrate that the world economy has always consisted of a patchwork and likely always will. It has always been driven by networks that connect particular nodes in a way that is anything but uniform or comprehensive. Globalization has never consisted of all-with-all trade or financial flows. Sectors differ from each other in their logics. And large parts of the world, notably Africa, are simply not included in the maps…Comparing the network of firms in February 2020 with that in December 2021 it would seem that the automotive industry network remained largely stable whereas that for Information Technology was subject to significant contraction. Whether or not these trends continue, it is tools of this kind, covering both real and financial interconnections that will enable us to trace future trends in globalization.

-

,Maybe Global Supply Chains Were a Bad Idea

Transporting parts from country A to country B is an obstacle course that seems to only get more complicated. If the trade war showed the risks of globalized supply-chains, the coronavirus may solidify that business model as a liability. While some factories have started to come back on line, many remain closed as China tries to contain a respiratory illness that has already killed more than 2,000 people. Deere & Co. said Friday that it would spend an extra $40 million on expedited freight to help ensure the availability of parts for its international operations as the virus threatens its supply chain. Meanwhile, Nissan Motor Co. is bracing for disruptions and parts shortages at plants as far away as the U.S. should facilities in the outbreak epicenter of Hubei — which are responsible for some 800 types of vehicle parts — stay idled much longer. Three General Electric Co. sites in Hubei are still closed, and others elsewhere in China aren’t at full staffing levels, Chief Executive Officer Larry Culp said at a Citigroup Inc. conference this week. While there’s sufficient buffer inventory right now, Culp said he anticipates any disruption to the supply chain to show up later in the spring.

- Brooke Sutherland, Bloomberg

China’s Gas Demand Is a Bigger Worry for Europe Than Russia Cutoff

For now, China’s total gas consumption is expected to rebound by almost 7% in 2023, according to the IEA. Europe’s usage dropped the most on record in 2022 and may ease slightly this year. The IEA and European Union officials have warned that consumption discipline remains critical for the continent given lower supplies from Russia, its former top supplier.

- Elena Mazneva, Bloomberg

Insular India’s exporters will struggle to fill Chinese shoes

India has already had a decade of opportunity to scoop up the industrial production leaving China. It has performed poorly, and its trade and investment policy is regressing towards unhelpful Indian traditions of protectionism and import substitution…Clothing and shoes, ceramics, leather goods, furniture — these are all mass-employment, labour-intensive manufacturing industries in which India ought to specialise. But raising tariffs to deter imported inputs means it struggles to be competitive in global supply networks. When China and Vietnam began their textiles and clothing export booms, respectively in the mid-1990s and the mid-2010s, foreign inputs made up more than 40 per cent of their exports. For India in 2015 the equivalent number was just 16 per cent.

- Alan Beattie, Financial Times

Over Half of US Manufacturing Employees Plan to Leave Their Jobs in 2023: Survey

A new survey of factory workers by Austin, Texas-based business software company Epicor reveals that high turnover is likely to remain a major feature of the manufacturing sector through 2023, and that many frontline workers tend to see free time and advanced facilities as top priorities aside from wages. In the online survey of more than 600 manufacturing employees, 56% said they plan to leave their current jobs sometime in 2023, sustaining the high turnover seen by manufacturing in the past few years.

- Industry Week

Nuclear Power’s Revival Reaches the Home of the Last Meltdown

Twelve years after one of the worst nuclear disasters in history shook Japan and turned the public against atomic power, a global energy crisis is encouraging the country to switch its reactors back on. Faced with rising heating bills this winter after a sweltering summer spent worrying about blackouts, more people are now reappraising the benefits of cheaper and more stable energy. Even some of those living near nuclear plants are looking beyond their fears of another radioactive disaster.

- Shoko Oda, Bloomberg

Chipmakers receiving US federal funds barred from expanding in China for 10 years

Chipmakers must agree not to expand capacity in China for a decade if they are to receive money from a $39bn US federal fund designed to build a leading-edge US semiconductor industry, according to new commerce department rules. The department on Tuesday called for applications for funds from the Chips Act passed by Congress last year, as it launched a landmark industrial policy programme designed to counter China. In announcing the move, commerce secretary Gina Raimondo stressed the department would be implementing safeguards to ensure the programme was not abused.

- Demetri Sevastopulo, Financial Times

Report identifies engineering research priorities for “unhackable infrastructure”

The Engineering Research Visioning Alliance (ERVA), a U.S. National Science Foundation-funded initiative, released a report outlining engineering research priorities to create research and development (R&D) and technology solutions to make infrastructure “unhackable.” The report challenges the engineering R&D community to develop proactive approaches rather than reactive measures that simply counteract identified threats. The aim is to fortify infrastructure security against a wide variety of adversarial threats while anticipating future technology developments and their security needs, including human-technology interfaces and quantum computing.

Human-technology interface considerations: Research should incorporate the human element and even recast the technical language from building secure “cyber-physical systems” to “cyber-physical-human systems.” The human interface is critical for computer system security modeling and design.

Measuring and verifying security: Advances in measurement tools and metrics for tomorrow's infrastructure are sorely needed to support security risk evaluation, verification, automation and more.

Future approaches to autonomous security: To address the complexity and scale of tomorrow’s infrastructure, research is needed for approaches in self-configuring, self-guiding and self-managing.

New approaches to resilience in interdependent infrastructures: As infrastructure becomes more complex and interconnected, one vulnerable access point can potentially open a door for hackers to do great harm. Design approaches are needed to maintain safety, security and resilience at the systems level, even when a modular component is attacked.

Architecting trustworthy systems: Design specifications, decentralized control, confidential computing and new infrastructure domains are priorities for research and development when considering how correctness of operation can be verified more robustly and built into system architectures and infrastructure.

- Electronics360

The IPO drought could end soon—if these factors converge

The IPO market remains dry, and a comeback to its pre-2022 glory will rely on a confluence of factors. Among them: a stabilized macroeconomic environment, more clarity on the direction of interest rates, greater alignment on pricing between buyers and sellers, and a company that leads the pack back onto the public exchanges. When these factors converge, the return to public listings will likely be swift and explosive—when that may happen depends on who you ask. For now, tumbleweeds continue to blow through the NYSE. “You've got to stop saying that, Jessica—that the IPO window is closed," David Ethridge, US IPO services leader at PwC, said to me in a call last week. "The market isn't closed. It's just difficult."

- Jessica Hamlin, PitchBook

Book Rec: The Econometric Analysis of Network Data

The Econometric Analysis of Network Data by Bryan Graham and Áureo de Paula serves as an entry point for advanced students, researchers, and data scientists seeking to perform effective analyses of networks, especially inference problems. It introduces the key results and ideas in an accessible, yet rigorous way. While a multi-contributor reference, the work is tightly focused and disciplined, providing latitude for varied specialties in one authorial voice.

Supply chain data on Turkey’s manufacturing sector recovery

Turkey’s manufacturing sector covers:

Vehicles, including models by Renault and Fiat, which are responsible 15.2% of Turkey’s total exports, totaling US$23.9bn

Machinery, which reaches US$13.8bn

Electrical equipment, to a sum of US$8.1bn

Resilinc’s data estimates that approximately 900 manufacturing, assembling, warehousing and distribution sites have been impacted by the earthquake. The most severely impacted industries are the automotive sector and general manufacturing. Resilinc’s data suggests that the recovery time for these manufacturers will take up to eight months…“severely damaged the countries' infrastructure…With ports and airport closures, road and rail damage, power outages, as well as oil and gas shortages, supply chains are already disrupted.”

- Helen Sydney Adams, Manufacturing

The Future of Electric Motors in the Automobile Industry

As automakers continue to pursue automotive electric solutions, Advanced Manufacturing Development (AMD) has created this eBook to discuss the future of electric parts in the automobile industry and some of the challenges associated with them, while offering expert solutions. The eBook covers the future of certain automotive components, the primary concerns of electrifying the automotive industry, and how manufacturers can overcome these challenges.

- Thomas & Advanced Manufacturing Development

The rise of reshoring & its customisation opportunities

Reshoring, the relocation of production and sourcing to the country of company origin has become more than media hype. A Deloitte report this year on freight points to 350,000 jobs being reshored to the US, a 25% increase in 2021…And by re-shoring, manufacturers should be able to manage a less complex supply chain, shorten their order lead time, and implement more advanced manufacturing processes with opportunities for enhanced customisation of products. With more flexible plants and less of the commitment to a single item design that accompanied may offshoring projects, customisation becomes more achievable.

- Umair Ejaz, Manufacturing

World’s Idled Container Ships Signal Bet on China Recovery

A slowdown in consumer demand — driven by weaker economic growth and higher inflation — is translating into fewer vessels needed for shipping goods from Asia’s top manufacturing hubs to the US and Europe. About 4.1% of the global container fleet, capable of carrying 1.067 million 20-foot container boxes, was idle in February, according to Drewry. That’s double the amount a year earlier, and near December’s 1.07 million container boxes, which was the most capacity taken out of service since August 2020.

- Ann Koh and Kevin Varley, Bloomberg

European Chips Act to strengthen EU’s semiconductor supply

Manufacturers want to recover pre-pandemic levels of supply to meet consumer demands and for those based in Europe, domestic production is one route to do this.

The European Chips Act aims to:

Embolden Europe’s research and technology leadership towards more efficient chips

Build framework to increase production capacity to 20% of the global market by 2030

Reinforce capacity to innovate in the manufacturing

Develop an understanding of the semiconductor supply chain

Encourage new manufacturing talent

- Helen Sydney Adams, Manufacturing

These ‘Net-Zero’ Banks Are Still Pretty Big on Big Oil

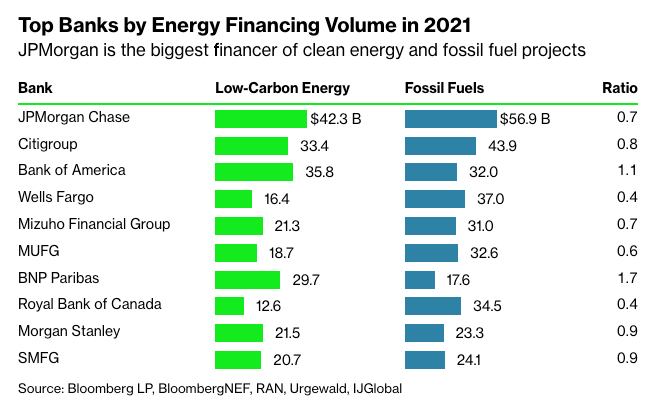

Banks that sign up for the Net-Zero Banking Alliance commit to align their lending and investment portfolios with the goal of achieving net-zero emissions by 2050. The goal is for a 4-to-1 ratio — with the 4 being the low-carbon part — to be reached by 2030. At the end of 2021, their average ratio was 0.92 to 1…In 2021, JPMorgan Chase & Co., the biggest US bank, had an energy-supply banking ratio of 0.7 to 1. That was slightly worse than Citigroup Inc. and Bank of America Corp., but better than Wells Fargo & Co.’s 0.4-to-1 ratio, according to BNEF. BNP Paribas SA did the best out of the 10 largest banks, coming in at 1.7 to 1. None of 10 largest financiers were anywhere near the 4-to-1 goal.

- Tim Quinson, Bloomberg