Bitcoin's Third Rail: The Code is Controlled

"Digital gold" is the prevailing definition of bitcoin. Bitcoin is suggested to be preferable because it is a commodity immune from human manipulation in the digital space. This is wrong. Whatever your opinion, we should at least get the definition right and argue from that ground.

Hype pumpers like to contrast digital gold to fiat central banks. Gold doesn't have a monetary policy, it just is. Bitcoin is alleged to not have a monetary policy, it just is. This is a false analogy because while we can't change the atomic structure of gold, we can change bitcoin.

Bitcoin is code. Code has to be created by humans. Code needs to be maintained by humans. Code needs to be updated by humans. Who are these humans?

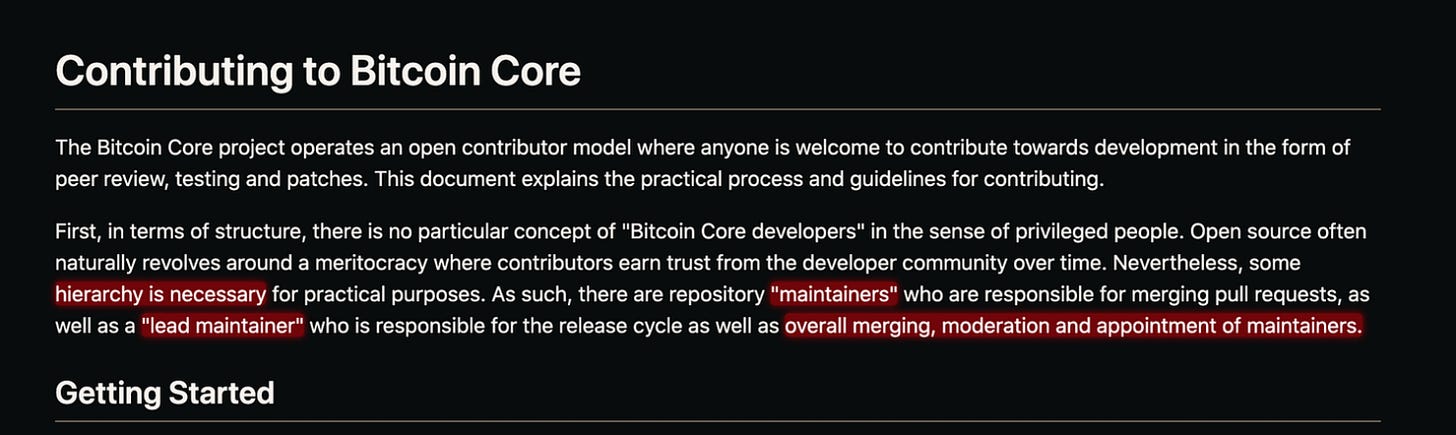

Satoshi Nakamoto may have created Bitcoin but there is a definitive hierarchy of individuals that supervise bitcoin's code. About 20-30 people are responsible for most of the decision-making with a long tail of smaller participants into the hundreds. The list of key programmers is listed on the official Bitcoin website as well as the official GitHub software repository. The "Contributing to Bitcoin Core" page on Github says "hierarchy is necessary" and that a "lead maintainer" exists.

Wladimir van der Laan is the most active developer and official lead maintainer. He is the leader of a money people usually say has no leaders. He even said a few months ago that he's a "centralized bottleneck" and "we need to start taking decentralization seriously." Which begs the question: were they not before?

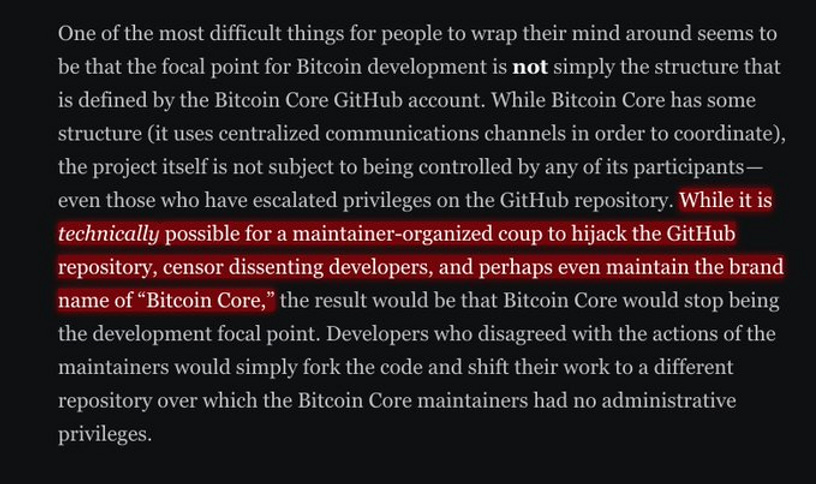

This identifiable leader, who says the code is centrally controlled, and a small group of subordinate active developers control the Bitcoin code - thus its monetary policy. In a bitcoin advocate's, Jameson @Lopp, own words, "technically" this small group could do whatever they wanted with the code (monetary policy). Can we technically say that about gold? No.

What stops the developers from radically altering the code for whatever motivation? Rightly so, the Bitcoin community or market reviews changes and decides to stay or exit to a better product. That's a fair explanation akin to leaving Ford for Toyota. But why is there intense pressure to erase the fact that Bitcoin is a corporation offering a private product?

Some reasons might be:

One, developers need to obfuscate the liability of operating a competing currency system. Two, gold versus fiat is a better marketing strategy than just fiat versus fiat. Three, some people are just naive and blindly parrot talking points from the above (I call this the Santa Fallacy).

While as Lopp and others suggest that maybe it is possible to change Bitcoin's monetary policy, it has never happened and is so improbable. But is that even true? The Rosetta of Bitcoin is BIP-42. BIPs are Bitcoin Improvement Proposals or code changes. Each one is proposed and successful ones are committed to the code. BIP-42 fundamentally altered the monetary policy of Bitcoin. Contrary to popular belief, the original code had Bitcoin's supply "grow indefinitely." In 2014, BIP-42 put the 21 million supply cap on Bitcoin. This is dismissed as just fixing a bug and is really no big deal but whether it was a bug or feature is irrelevant. Why? BIP-42 proved that the most dearly held immutable policy of Bitcoin could be changed. It also proved that this shift could go largely unremarked upon.

Overall, this should not dissuade or persuade anyone from any investment decision regarding Bitcoin but it should allow them to be better informed and make their thesis on the correct foundation. This also allows them to see which hype pumpers are promoting a faulty definition. Some do know better.

Bitcoin is not digital gold. It has a small and identifiable group of human developers that determine the code. They meet, discuss, change, add, subtract, etc. There's no getting around the fact that this process is equivalent to that of monetary policy. Bitcoin is a *private* central bank. Does the picture below look familiar? Jerome Powell is the lead maintainer of the Fed.

Footnote #1: Just to clarify one of the novel things about crypto is the public disclosure of all data. This allows the market of competitors to take up data and start a new project based on it. This is more to do about open source software practices in tech history. In theory, this allows for decentralized code control but in history this idea has not been proven. Older open source technologies have also shown to not scale and last in this manner.

Footnote #2: @elmalandr0 does an awesome job articulating the humanness of Bitcoin at an impressive depth of technical history.

Footnote #3: Miners are decentralized in the degree that they compete in a market to solve blocks and push through transactions. Business, technology, and regional monopolization have shown signs of eroding this, however, block solving is determined ultimately by computing power and not by a human organization such as the code.

Footnote #4: The other main area of centralization in Bitcoin is the exchange ecosystem. There are relatively few exchanges around the world and fewer that deal with most of the users. These corporations are gatekeepers to buy and sell Bitcoin. Thus they have disproportionate power in controlling Bitcoin in general. For example, if the Bitcoin code changes in a direction they don't like a few CEOs could decide that is no longer considered Bitcoin and users would be prohibited from interacting with it.

Sources:

https://github.com/bitcoin/bitcoin/blob/master/CONTRIBUTING.md

https://github.com/bitcoin/bitcoin/graphs/contributors?from=2009-09-14&to=2021-02-19&type=c

https://bitcoin.org/en/development#bitcoin-core-contributors

https://blog.lopp.net/who-controls-bitcoin-core-/

https://www.coindesk.com/bitcoin-core-lead-maintainer-steps-back-encourages-decentralization

https://laanwj.github.io/2021/01/21/decentralize.html

https://github.com/bitcoin/bips/blob/master/bip-0042.mediawiki

https://ericscrivner.me/2018/07/bip-42-and-bitcoins-fixed-monetary-supply/